Short selling your home is a viable option when your home is worth less than what you owe on the mortgage, and you can no longer make your mortgage payments due to financial hardships. In these cases, you need to explain your situation to your lender and how it has impacted your ability to continue to pay down your loan.

Understanding which situations qualify enables you to know whether this is a viable option for you to explore. Continue reading to find four different types of hardships for a short sale.

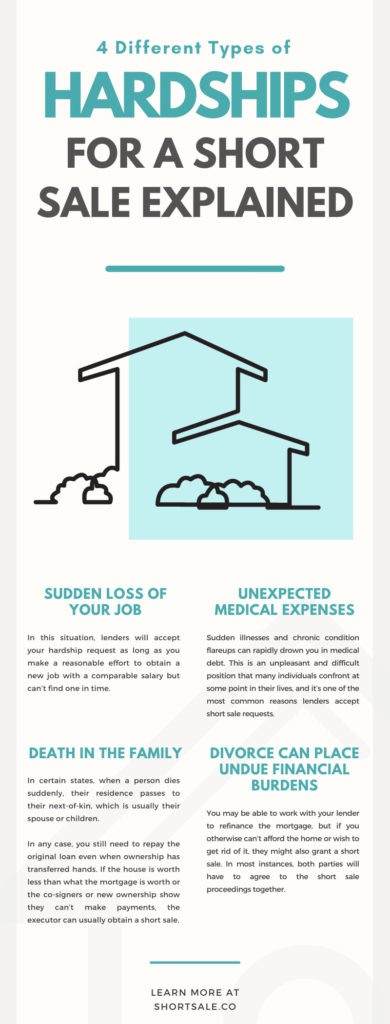

Sudden Loss of Your Job

Your employment and job stability are two of the most crucial factors lenders will consider before granting you a mortgage. The reasoning behind this is that you need to show them that you have a steady income and can continue to make your mortgage payments for the foreseeable future. In most cases, you’ll need a full-time, permanent job.

However, circumstances beyond your control, such as a market downturn, may result in the loss of your employment. When this happens, you may not be able to afford the payments you could cover before. In this situation, lenders will accept your hardship request as long as you make a reasonable effort to obtain a new job with a comparable salary but can’t find one in time.

What Percentage of Your Income Should Goes to Your Mortgage?

As a rule of thumb, most potential homeowners should only finance a home if it costs two to two-and-a-half times their yearly gross income. In this case, someone making $50,000 annually should only buy a house that costs $100,000 to $150,000.

However, lenders look at several factors, including your gross income, front-end ratio, and back-end ratio. The front-end ratio is the percentage of your yearly income you can dedicate towards your mortgage each month and typically won’t exceed more than 28 percent, although there are some exceptions. The back-end ratio is the amount of your gross income you need to cover your debts; it shouldn’t exceed more than 43 percent.

Unexpected Medical Expenses

Sudden illnesses and chronic condition flareups can rapidly drown you in medical debt. In addition to expenditures that can quickly mount into the tens of thousands of dollars, being ill can prevent you from working, depleting your savings and making it more challenging to keep up with your mortgage payments. This is an unpleasant and difficult position that many individuals confront at some point in their lives, and it’s one of the most common reasons lenders accept short sale requests.

Death in the Family

It’s never easy when someone dear to you passes away. In some circumstances, that person may have also been the primary source of income in your home, or their passing may make it more difficult for you to keep up with your mortgage payments. In certain states, when a person dies suddenly, their residence passes to their next-of-kin, which is usually their spouse or children.

In any case, you still need to repay the original loan even when ownership has transferred hands. If the house is worth less than what the mortgage is worth or the co-signers or new ownership show they can’t make payments, the executor can usually obtain a short sale.

Planning Your Estate

While you can’t ever plan for every circumstance, death is inevitable, and homeowners should try and prepare for worst-case scenarios to help ease the burden of their loved ones. Whenever possible, the homeowner should put some money aside in a savings account or other asset that relatives will acquire after they pass away. This will allow them to keep making mortgage and tax payments until they decide whether or not to keep the house.

Divorce Can Place Undue Financial Burdens

When you and your spouse own a property together, you may have had a mortgage approved based on your joint income or made payments with one of your salaries. These instances can be tricky, as ownership may remain in both of your names, or it could transfer to solely one person. In any case, a divorce can make one or both of you unable to keep up with installments.

You may be able to work with your lender to refinance the mortgage, but if you otherwise can’t afford the home or wish to get rid of it, they might also grant a short sale. In most instances, both parties will have to agree to the short sale proceedings together.

Can Be Complicated To Navigate Without Help

There are several factors to consider in a divorce, such as who will live in the house until you sell it and who will pay for repairs. To properly navigate these conditions, you should consult with your divorce attorney and short sale specialists. You’ll need to know how to handle essential concerns, like taxes owed and credit impact due to the short sale.

How To Let Your Lender Know You’re Facing Hardships

Once you realize you’re facing or about to face financial hardships, you need to inform your lender as soon as possible, preferably before you miss your first mortgage payment. Typically, you will send a formal letter (a hardship letter) explaining your current situation and why you need a short sale. Your letter should provide the lender with a comprehensive picture of your present financial condition and explain how you came to be in this position.

To paint a complete picture of your situation, you will typically need to pair this letter with pay stubs, a financial statement, tax returns, bank statements, and other financial information. Instead of drafting a letter, some lenders will want you to fill out a hardship form (a hardship affidavit) or a hardship statement, so check with them ahead of time to see what documents they require.

How To Write Your Hardship Letter

While templates are available, you should only use these examples as jumping-off points and make your letter personal to your situation. Working with professionals, like the ones you’ll find at Short Sale Cooperative, can also help you draft this and present the most robust case possible. Generally, these letters include the following:

- Contact information

- Introduction

- Body

- Conclusion

You should aim for a one-page max. Try to be concise and include only the pertinent facts to your case.

Other Potential Reasons

While these are some of the most common financial difficulties that lenders are looking for, there are many other circumstances that could qualify. These include:

- An abrupt change in the terms of a mortgage (i.e., adjustable-rate loan)

- Military service

- Incarceration

- Significant and extensive repairs needed on the house

- Employment transfer

- Reduction in income due to furlough, job cut, etc.

- Expenses and debts have dramatically increased

We hope having four different types of hardships for a short sale explained helps you figure out if a short sale is right for you. Working with the experts at Short Sale Cooperative can help you navigate a tricky process and answer any questions, big or small.

We will go into tremendous detail answering, “What does it mean to short sale a house?” and the following implications. Feel free to contact us with any questions you may have.

Recent Comments