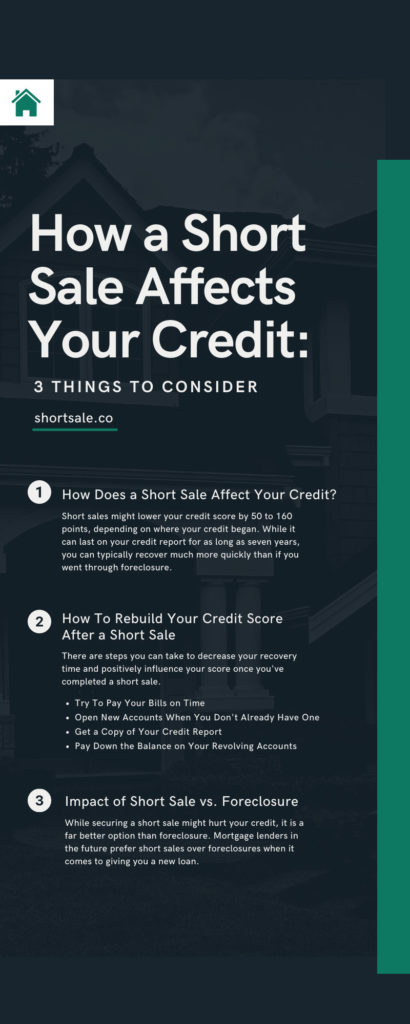

Performing a short sale on your home is often a difficult but necessary decision when you're having trouble paying your mortgage. Understanding the potential financial ramifications of completing this type of sale can help you put yourself in the best possible position to bounce back. For anyone who wants to know how a short sale affects your credit, here are three things to consider.

How Does a Short Sale Affect Your Credit?

Short sales might lower your credit score by 50 to 160 points, depending on where your credit began. While it can last on your credit report for several years, you can typically recover much more quickly than if you went through foreclosure. You may even be able to secure financing for a new house in as little as two years if you meet certain conditions.

Did You Miss Payments Before Completing the Short Sale?

The best time to approach your lender for a short sale is before you miss any payments. Once you let your mortgage payments go into delinquency, you might experience an immediate negative effect on your credit.

Even if your short sale does get reported as a settled account, making all your payments promptly may serve to mitigate or postpone the negative impact on your credit ratings. Current and potential lenders may also look more favorably when reviewing your credit report in the future.

Will You See a Short Sale on Your Credit Report?

Short sales appear on your credit report but can be easy to miss if you don't know what to look for. That's because you won't see the words "short sale" appear. Instead, your mortgage loan account uses unique coding, labeling it as "settled" and "account lawfully paid in full for less than the whole sum."

When this information finally does pop up on your credit report, you may see a drop in your score. The actual number of points you gain or lose is determined by the other information in your credit report, the scoring algorithm, and whether your lender discloses a deficiency balance.

Tip for the Future

You should secure a letter from your lender that confirms your short sale. This can be helpful when applying for another loan to purchase a new home.

How To Rebuild Your Credit Score After a Short Sale

Like other significant adverse circumstances, a short sale can take a long time to recover from, credit score-wise. If you had a particularly elevated level of credit, it could be several years before you're able to recover fully. However, there are steps you can take to decrease your recovery time and positively influence your score once you've completed a short sale.

Try To Pay Your Bills on Time

When you pay your bills on time, you add positive information to your credit reports, which raises your credit score. On the other hand, past due payments will hurt your credit score, so make sure you pay at least the minimum amount due each month.

Open New Accounts When You Don't Already Have One

You should try opening new accounts to help build up your credit if you don't already have a conventional loan or credit card. When you have abysmal credit, you might consider secured cards, which have a security deposit, or a credit-builder loan where the money stays in the bank while you make payments. If your credit is high enough, another great option is to investigate credit cards with great rewards such as zero annual fees.

Get a Copy of Your Credit Report

Many people may not realize potential mistakes in your credit report that can drag down your score. You should order a copy of your credit report from the three major credit bureaus – TransUnion, Equifax, and Experian. Look for errors you can correct, such as applying for credit under a different name by accident.

Pay Down the Balance on Your Revolving Accounts

A revolving account is a form of credit account that gives you a maximum credit limit while also allowing for variable credit availability, such as credit cards and certain lines of credit. When you pay down your balance on these accounts, you help reduce your credit utilization ratio and boost your credit score quickly. While paying down installment accounts (car, student, and personal loan amounts) will slowly improve your scores, it won't have the same impact as reducing your credit utilization ratio does.

What Is a Credit Utilization Ratio?

The amount of revolving credit you're presently using divided by the entire amount of revolving credit you have available is your credit utilization ratio. To put it another way, it's the amount you owe now divided by your credit limit.

Impact of Short Sale vs. Foreclosure

While securing a short sale might hurt your credit, it is a far better option than foreclosure. When your house gets foreclosed on, it indicates you quit paying your mortgage, and the lender had to pursue legal action to seize possession of the property to retrieve the debt.

As a result, being in foreclosure will have a significant negative influence on your credit ratings. Ultimately, mortgage lenders in the future prefer short sales over foreclosures when it comes to giving you a new loan.

When Does the Foreclosure Process Occur?

Lenders often notify you that they will seize and resell your property if you have missed three consecutive loan payments and have not made a payment within the 90-day term. Once you receive that notice, you usually have 30 days to bring the loan current or risk losing your house. As a result, if the foreclosure goes through, you will have missed at least four payments.

How Long Does a Foreclosure Last on Your Report?

If you obtained your short sale before missing any payments, there's a good chance you can avoid considerable influence on your credit score in the future. On the other hand, a foreclosure stays on your credit record for seven years from the date of the first default. Although the impact may fade sooner, they might nonetheless affect your ability to purchase a new house.

This guide on the three things to consider about how a short sale affects your credit can hopefully prepare you financially for life after your short sale. Short Sale Cooperative's professionals can also further assist you with potential short sale credit implications to help you stay informed. Feel free to contact us with any questions about our services.

Recent Comments