Anyone in the position where they need to perform a short sale can find it hard to know where to begin in the process. It is critical to understand the proper steps to take to successfully sell your house, especially if you are in financial distress. Read on to discover how to start with a complete guide to the short sale process.

What Is a Short Sale?

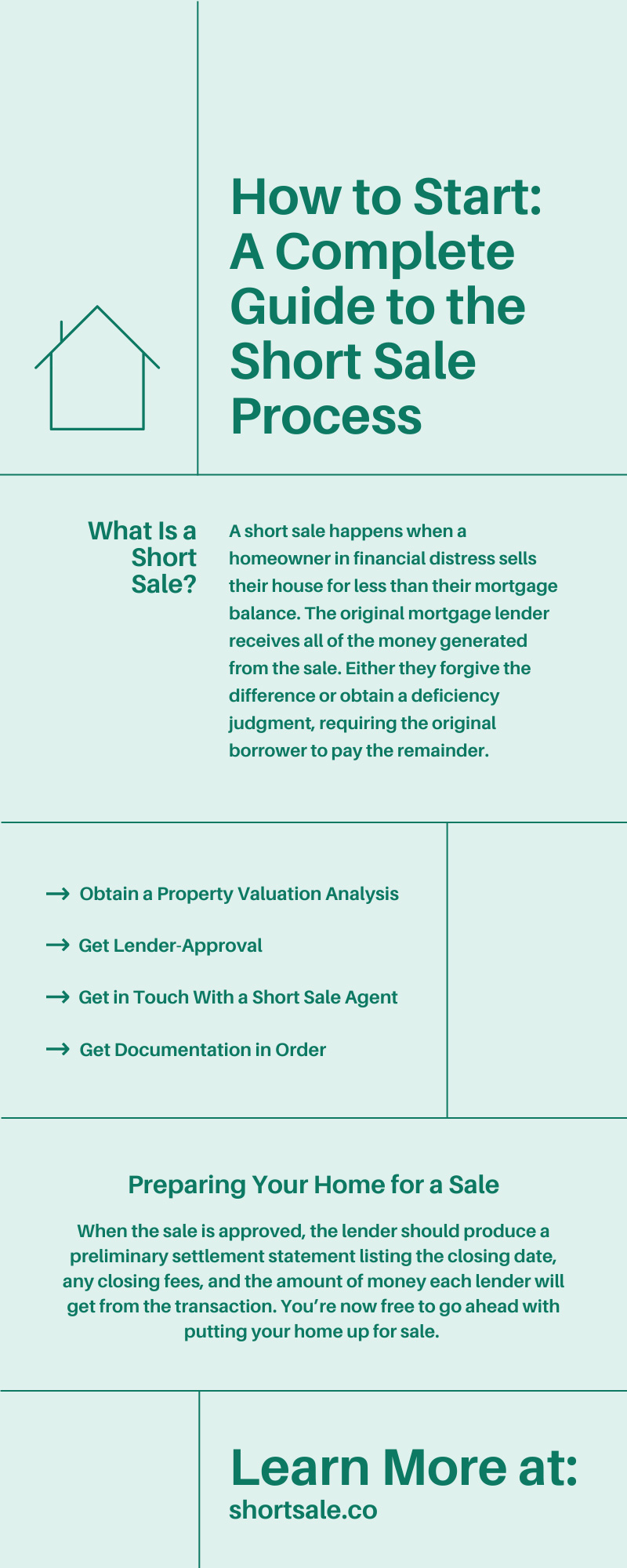

A short sale happens when a homeowner in financial distress sells their house for less than their mortgage balance. The original mortgage lender receives money generated from the sale. Either they forgive the difference or obtain a deficiency judgment, requiring the original borrower to pay the remainder.

Why Choose a Short Sale?

While it isn’t the most ideal situation, it’s preferable to foreclosure. A short sale will have a far lower impact on your credit score than a foreclosure. In addition, homeowners who have gone through a short sale can generally purchase another home more quickly than if they let a foreclosure occur.

Recognize When You Need Help

Before you can go ahead with a short sale, you must first identify when you are in financial distress and cannot make your mortgage payments. Before deciding to try a short sale, you may explore other choices. However, if you’ve exhausted all your alternatives, you should contact your lender as quickly as possible to determine if you qualify for a short sale. Or, reach out to an experienced short sale negotiator or short sale processing company to discuss your situation and see if you may qualify for a short sale.

Obtain a Property Valuation Analysis

Your lender is unlikely to accept a short sale proposal if there’s enough equity in the home to allow it to break even if foreclosure happened instead. You need to show that you owe more on your mortgage than your home’s fair market value, which means you need to get it valued by a professional.

Get Lender-Approval

Your next step is to explain your situation to your lender and check into selling your property for less than the amount owed on your mortgage. This is tricky, as lenders are not keen to sell a home for less than it’s worth, so you will need to show why it’s a better option for them than foreclosure. Additionally, you will need to send all the evidence of why you should be granted a short sale in a written letter to the lender.

What You Need to Show to the Lender

When you have loans from multiple lenders, you will need to send a written letter to each one separately. You need to prove that you’re experiencing a unique hardship that affects your ability to pay, among other things. Here is what you need to show:

- The value of your home is less than the amount you owe, plus any closing fees.

- You’re already in default or will be soon.

- You are having financial difficulties preventing you from completing your loan commitments, such as unemployment or a medical emergency.

- You do not have sufficient income or assets to pay off your loan. Anything of value that can be used to repay the debt, such as other real estate, investments, or accessible credit, is considered an asset.

Get in Touch with a Short Sale Agent

You’ll undoubtedly want a professional by your side with extensive experience with short sales to help you navigate the extremely complicated and time-consuming process. When you contact the short sale agent, they will evaluate your financial position, do a comparative market analysis (CMA), obtain an appraisal to figure out the property’s worth, and decide the optimum price for the listing. You’ll also need to sign a written agreement for the real estate agent or short sale professional to get in contact with your lender regarding your account, have the lender supply a short sale package, and list the home at a price indicative of fair market value.

Get Documentation in Order

Next, you will deliver a short sale package to your lenders. You should include hardship paperwork, bank statements and account information, property taxes, bills, income taxes, asset declarations, and any other pertinent documents. The lenders will examine the material supplied and do their research as well.

Lenders either don’t react, decline the offer altogether, decline the offer but specify what must change and what conditions they’ll approve, or take the offer as stated in this stage of the short sale process. Lenders will send you a short sale approval letter explaining the conditions of the agreement if it is authorized. Your short sale agent or short sale negotiator can work with the lender to make any requested adjustments to the provisions of the approval letter, if needed.

Preparing Your Home for a Sale

When the sale is approved, the lender should produce a preliminary settlement statement listing the closing date, any closing fees, and the amount of money each lender will get from the transaction.

Your short sale agent or short sale negotiator will usually take things from here, handling any necessary marketing, securing a buyer, and walking them through contact details. When possible, get a declaration renouncing the lender’s right to seek a deficiency judgment against you, releasing you from any need to pay off the mortgage amount once the sale is final.

Conclusion

We hope this has helped you figure out how to start the short sale process. After you complete your short sale, you will need to wait a certain amount of time before you can qualify for various mortgage loans. Still, as long as you rebuild your credit and place yourself in a financially favorable position, you should have another opportunity to buy a home in the future.

The experts at Short Sale Cooperative understand that the short sale process is difficult to do alone, and we’re here to help you every step of the way. We can perform many different essential tasks, like explaining the short sale process, communicating with your lender, and helping with the paperwork. Feel free to contact us today with any questions you may have.

Recent Comments